FY2024-2026 Sony Financial Group

Progress of the Mid-Range

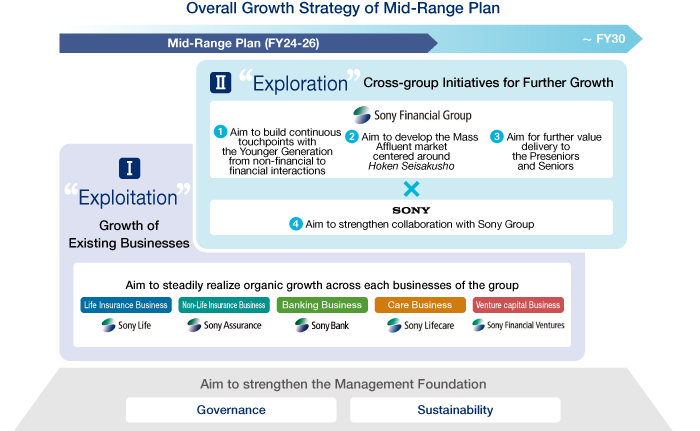

The current three-year Mid-Range Plan, which began in FY2024, is now in its second year. In the Mid-Range Plan, the Sony Financial Group, by backcasting from its vision for FY2030, formulated strategies based on the concepts of “Exploitation” and“Exploration” within an ambidextrous management approach. Sony FG aims for sustainable increases in corporate value through both “Exploitation,”the growth of existing businesses, and “Exploration,” the cross-group initiatives for further growth.

Overall Growth Strategy of Mid-Range Plan

Ⅰ “Exploitation” Growth of Existing Businesses

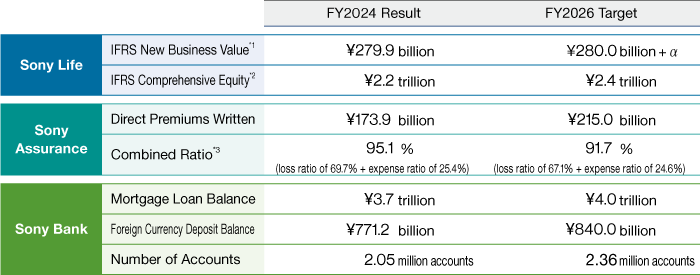

Sony Life

Sony Life has achieved strong growth in Japan’s life insurance industry, with both business scale and market share continuing to expand. By uncovering latent protection needs through consulting-based sales, a strength of Sony Life, annualized premiums from policies in force have steadily increased, and the new policy amount ranked No. 1 domestically for the third consecutive year.*

Leveraging the consulting capabilities developed through insurance sales to individual customers, Sony Life has also differentiated itself in insurance sales to corporate customers, which has led to acquiring new policies in the corporate customer market. Both Lifeplanner sales specialists, who facilitate these achievements, and agency supporters, who support insurance sales and management at agencies, have maintained high productivity while also achieving headcount growth. Going forward, Sony Life will work to create a virtuous cycle that enhances its sales capabilities through improved productivity and talent acquisition, leading to still further growth.

Note: Calculated based on financial results of domestic life insurance companies for FY2022 to FY2024

Sony Assurance

Sony Assurance has steadily expanded its top line, centered on direct auto insurance. Although the loss ratio is trending upward due to an increase in natural disasters and rising insurance claim unit costs, the combined ratio* remains low within the industry and is being controlled through appropriate rate revisions. As for fire insurance, Sony Assurance aims to make it a second pillar by leveraging the marketing expertise and appropriate rate-setting know-how based on risk segmentation developed through auto insurance, and is working toward steady growth in this area as well.

Note: Combined ratio is calculated as the total of the net loss ratio and net expense ratio

Sony Bank

Sony Bank continued to see stable profit growth centered on its core businesses of mortgage loans and foreign currency operations. Average deposit balances per account are at a high level compared to our competitors. In mortgage loans as well, Sony Bank maintains a low default rate relative to the industry and a high-quality customer base. Further, with the next-generation digital banking system launched in May 2025, Sony Bank aims to expand its business scope by enabling rapid provision of products and services.

Ⅱ “Exploration” Cross-group Initiatives for Further Growth

Amid a shrinking Japanese population, the main focus of the cross-Group “exploration” initiatives is expansion of the customer base. In addition to our traditional core customer base of families, we are exploring and promoting a variety of measures to expand into younger, senior, and affluent segments. In particular, Sony Bank is working to expand Sony FG’s customer base by creating customer touchpoints rooted in life events and entertainment experiences through collaboration with the Sony Group.

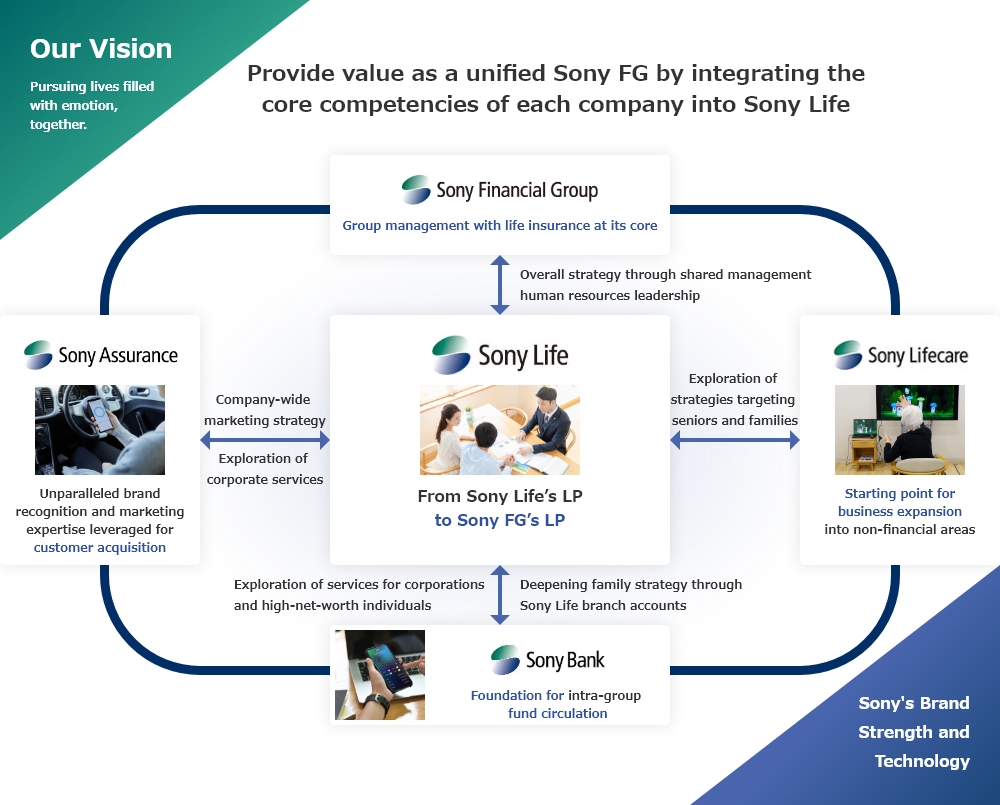

With the aim of providing value as a unified Group with Sony Life at its core, Sony FG will substantially integrate the core competencies and functions that each business has demonstrated thus far into Sony Life, which boasts the greatest growth in added value in the Group.

Approach to the group strategy of the Sony FG

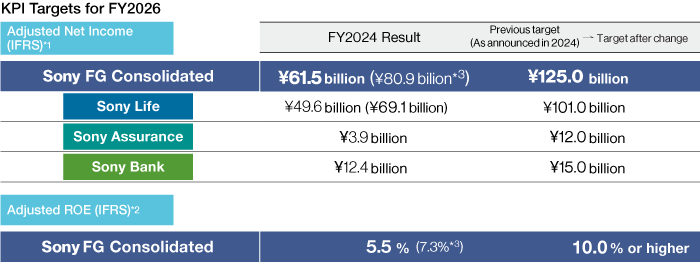

Numerical Management Targets of Mid-Range Plan

As targets for FY2026, the final year of the current Mid-Range Plan, Sony FG aims to achieve adjusted net income of ¥125

billion (previously announced target of ¥120 billion) and adjusted ROE of 10% or higher on an IFRS 17 basis.

SFGI intends to apply Japanese GAAP at the time of its scheduled listing in September 2025, but plans to transition to IFRS in FY2026. This is because IFRS is a more consistent way of presenting the timeline of business and profit growth in insurance, which is SFG’s main business, and because it is an accounting standard that can be regarded as a global standard.

*1 Net income – Adjustments for each entity

*

*Adjustments for each entity(all after tax)

Sony Life:

(1) Investment income (net) related to variable insurance

1 and foreign currency translation differences (excluding the equivalent of hedge costs

2), (2) Unrealized gains/losses related to variable insurance within insurance finance expenses (income)

3 and foreign currency translation differences, (3) Gains/losses on sales of securities, (4) Other one-time gains/losses

Note1: Investment income (net) related to variable insurance is financial assets measured at FVPL, associated with

variable life insurance and individual variable annuity contracts.

Note2: Transaction fees and margin costs required to maintain hedge positions. Includes current accrued interest from bonds designated as measured at fair value through net profits/losses (FVO designated) based on the interest rate at the beginning of the period.

Note3: Effect of changes in the value of underlying items of variable life insurance and individual variable annuity contracts and changes in interest rates and other financial risks.

SFGI, Sony Assurance, Sony Bank, other entities: One-time gains/losses

*2 Adjusted net income / net assets

*

*Net assets as the denominator is the quarterly average net asset during the fiscal year: (beginning of the period balance + end of four quarters balances) / 5

*3 The figures in parentheses are amounts added back to reflect the impact of tax rate changes introduction of the defense special corporation tax) (Sony FG consolidated: 19.4 billion yen; Sony Life non-consolidated: 19.5 billion yen.

*1 Post-tax IFRS NBV is calculated as the total of new business CSM and new business loss component, using Sony Life’s effective tax rate.

*2 IFRS comprehensive equity is calculated as the total of the IFRS shareholders’ equity and post-tax CSM.

*3 Combined ratio is calculated as the total of the net loss ratio and net expense ratio.