Financial Results and Earnings Forecast: Q3 FY25

IFRS

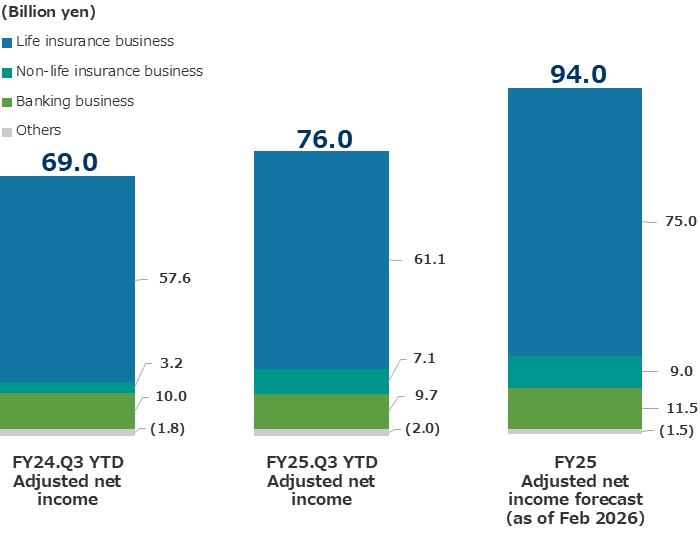

Group consolidated adjusted net income (IFRS)*1 for FY25.Q3 and FY25 Financial results forecast (IFRS)

- Consolidated adjusted net income for FY25.Q3 YTD was 76.0 billion yen (increased 10% year-on-year) due to the increase in the life insurance and non-life insurance businesses, despite decrease in the banking business.

- In the life insurance business, although loss components increased due to changes in estimated future cash flows of insurance policies and rising interest rates, adjusted net income increased mainly due to decrease of repo interest, etc.

- In the non-life insurance business, adjusted net income increased mainly due to a decrease in natural disasters.

- The progress rate against the revised forecast is 81% for FY25.Q3 YTD.

(Billions of yen)

|

FY2025 (Forecast) |

FY2025.Q3 YTD |

Achievement |

| Adjusted net income |

94.0 |

76.0 |

81% |

Note1 SFGI consolidated net income - Adjustments for each entity

※

※Adjustments for each entity (post-tax) Sony Life: ①Investment income (net) related to variable insurance and foreign currency translation differences (excluding the equivalent of hedge costs) , ②Unrealized gains/losses related to variable insurance within insurance finance expenses (income) and foreign currency translation differences, ③Gains/losses on sales of securities, ④Other one-time gains/losses

SFGI, Sony Assurance, Sony Bank, Other entities: One-time gains/losses

J-GAAP

Financial Results Overview

Consolidated ordinary revenues increased 10.0%, compared with the same period of the previous fiscal year (year-on-year), to 2,559.6 billion yen, due to an increase in ordinary revenues from the life insurance, the non-life insurance and the banking businesses. Consolidated ordinary profit increased 82.6% year on year, to 98.6 billion yen, due to an increase in ordinary profit from the life insurance and the non-life insurance businesses, whereas ordinary profit from the banking business decreased. Profit attributable to owners of the parent increased 83.9% year on year, to 67.1 billion yen.

Financial Position Overview

As of December 31, 2025, total assets amounted to 24,511.1 billion yen, increased 4.9% from March 31, 2025. Among major components of assets, securities, mostly government bonds, amounted to 18,808.0 billion yen, increased 7.3% from March 31, 2025. Loans amounted to 3,851.5 billion yen, decreased 1.2%.

Total liabilities were 23,846.4 billion yen, increased 5.0% from March 31, 2025. Major components of liabilities included policy reserves and others of 16,604.1 billion yen, increased 4.9%, and deposits totaled 4,491.4 billion yen, increased 5.8%.

Total net assets were 664.7 billion yen, decreased 0.7% from March 31, 2025. This included net unrealized gains (losses) on available-for-sale securities, net of taxes, which decreased by 15.0 billion yen, to 88.1 billion yen.

Future Outlook

The company expects its ordinary profit and profit attributable to owners of the parent are expected to fall below the previously announced forecast, mainly due to an anticipated increase in losses on sales of securities resulting from additional sale of bonds for the purpose of rebalancing based on the ALM (asset-liability management) approach, conducted by Sony Life Insurance Co., Ltd.

|

Ordinary profit |

Profit attributable to owners of the parent |

Basic earnings per share |

| Previous forecast (A) |

122.0 billion yen |

820.0 billion yen |

11.47 yen |

| Revised forecast (B) |

79.0 billion yen |

50.0 billion yen |

7.09 yen |

| Change (B-A) |

(43.0) billion yen |

(32.0) billion yen |

- |

| Percentage change (%) |

(35.2) |

(39.0) |

- |

(Reference)

FY ended March 31, 2025 |

44.8 billion yen |

78.7 billion yen |

11.02 yen |