The Sony Financial Group has made sustainability a priority issue for management.

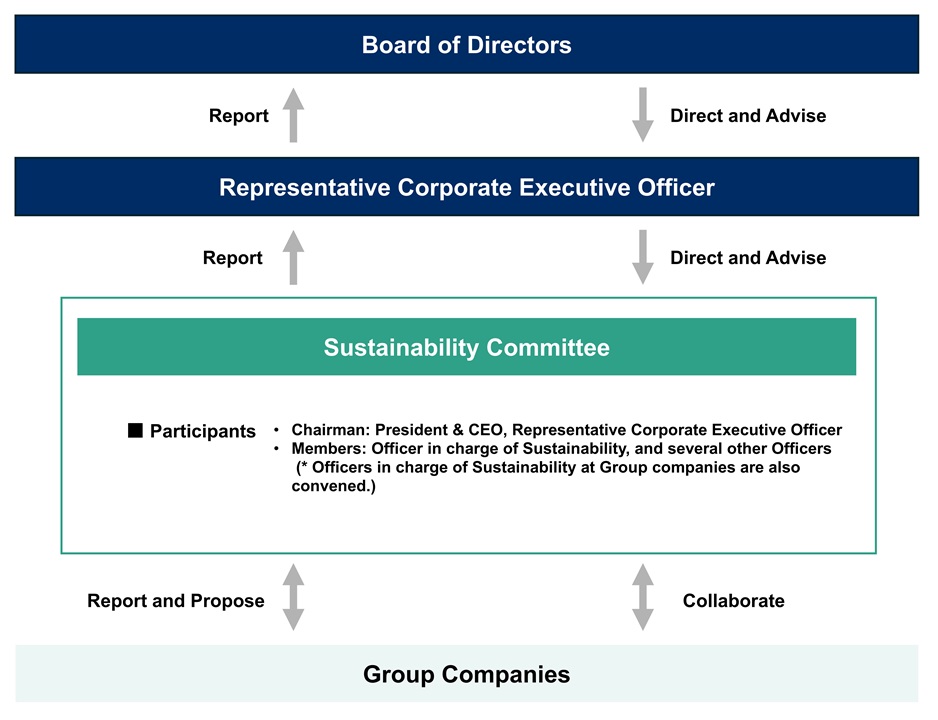

To ensure that our sustainability management is effective, we established the Sustainability Committee, chaired by the President & CEO, Representative Corporate Executive Officer with members including the Officer in charge of Sustainability, as well as several other Officers. Officers in charge of Sustainability at Group companies are also convened, which deliberates on matters concerning the overall promotion of sustainability for the Group, as well as issues and risks, and reports to the Board of Directors as needed. Our sustainability initiatives are also linked with executive compensation. All executives recognize the importance of sustainability activities and are actively promoting them.

Moreover, we established the Sustainability Promotion Office as a dedicated department within the Corporate Planning Department to further strengthen our structure for promoting sustainability through the concerted efforts of the Group.

Click to enlarge

The Sony Financial Group discloses information related to climate change (“climate-related information”) in line with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) as follows.

We will continue making a Group-wide effort to disclose climate-related information in a clear way, and to take further steps to respond to climate change.

Climate-Related Information in Line with TCFD Recommendations (May 2025 standard) (PDF 580KB) (Japanese language only)

Promoting ESG Investment

Group-wide ESG Investment Policy and Medium- to Long-Term Targets

The Sony Financial Group formulated a Group-wide ESG Investment Policy in 2022. The policy stipulates that investment decisions need to take ESG perspectives into account, as well as incorporating the perspective of stewardship activities to enhance the sustainability of investee companies.

Each Group company has formulated investment management regulations in line with this policy, and we are promoting the establishment of an ESG investment system, including the introduction of new investment methods such as ESG integration. In addition, we are strengthening our engagement with investee companies.

The Sony Financial Group has set medium- to long-term targets for the Group’s overall cumulative ESG loans and investments (over ¥500 billion by the end of FY2030). We steadily execute loans and investments, and actively participate in exchanges of opinion with institutional investors and study groups (workshops) led by relevant industry bodies.

Sony Financial Group ESG Investment Policy (May 29, 2025) (PDF 130KB) (Japanese language only)

Implementing ESG-Related Investments

The Sony Financial Group promotes investments in ESG-related projects (green bonds, social bonds, sustainability bonds, etc.).

We invest in a wide range of targets, from corporations and national university corporations to independent administrative agencies and local governments. Through these investments we continue to promote sustainability activities while upholding our duties as a responsible investor and making further contributions to a sustainable society.

The South African rand-denominated Green Bond, arranged at the request of Sony Bank in September 2022 and issued by the African Development Bank, received the “Green bond of the year supranational” award at the Bond Awards 2023, announced by the UK-based environmental finance magazine Environmental Finance.

Contribution to Achieving the SDGs

The Sony Financial Group aims to meet stakeholder expectations while also achieving increases in corporate value and the development of a sustainable society. By promoting these initiatives for improving our sustainability, we also contribute to the achievement of the Sustainable Development Goals (SDGs).

The SDGs are listed in the 2030 Agenda for Sustainable Development adopted at the United Nations Summit of September 2015. They are common global growth strategies to 2030, and consist of 17 goals and 169 targets.