Group ERM*

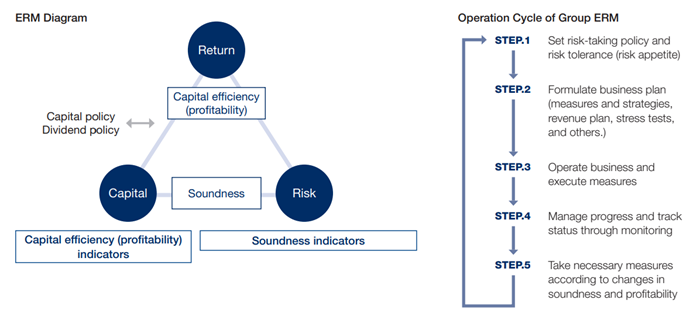

A group-oriented ERM (Enterprise Risk Management) framework has been introduced into Sony FG. It aims to balance and optimize capital, risk and return and to instill the idea of improved capital efficiency in management across the Group. This ERM framework will help Sony FG achieve stable growth and maximize medium- to long-term corporate value. The Group is working to build a PDCA cycle through the formulation, implementation and monitoring of business plans based on risk appetite. Furthermore, we are trying to raise Group ERM even higher while keeping related regulatory trends in sight.

Note: Enterprise Risk Management

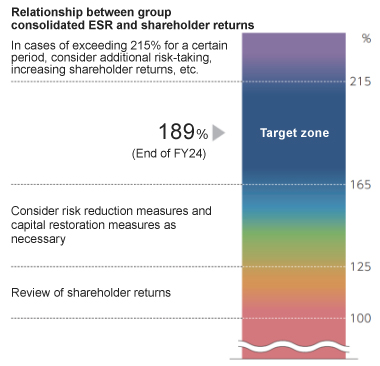

Consolidated Group ESR*

Sony FG has designated consolidated Group ESR, an indicator of capital sufficiency with respect to the Group’s risk amount, under its “Basic Policy on Group ERM,” and utilizes it as a key indicator to guide management judgement based on a balanced consideration of revenues, risks and capital.

Note: Economic Solvency Ratio